Q3 2025 MedTech Market Recap: A Data-Driven Guide for MedTech Service Providers

November 07, 2025 | Kevin Saem, Ph.D. |

MedTech Industry Report

INTRODUCTION

The MedTech market is undergoing a seismic shift. While overall funding figures for 2025 appear steady, a deeper look reveals a more concentrated landscape, with a handful of mega-deals capturing the lion's share of capital. For MedTech service providers, the old "spray and pray" approach of mass cold outreach is no longer a viable growth strategy. As venture capital becomes more selective and risk-averse, service providers must abandon the pursuit of every newly funded company and instead adopt a precise, data-driven approach.

This new reality demands a focus on sales effectiveness, not just efficiency. It's time to rethink your go-to-market strategy, and the blueprint is surprisingly simple: act like an engineer. Draw inspiration from Elon Musk's framework: question every assumption, delete what's unnecessary, and then optimize what remains. By applying this logic to sales and marketing, you can ensure your outreach is hyper-targeted and effective before you ever attempt to scale it.

This report, powered by data from Zapyrus, will provide actionable insights into the current state of the MedTech market and outline how a strategic shift to trigger-based sales can help your entire commercial team turn critical buying signals into revenue.

We'll explore:

- Growth Opportunities: Which regions and customer segments offer the most promising opportunities for service providers in 2025.

- Outsourcing Trends: The specific services MedTech companies are most likely to outsource, from MedTech clinical trials to regulatory support—and why.

- Talent and Regulatory Dynamics: How changes in the regulatory landscape are impacting product approval timelines and creating new opportunities for expert service firms.

- Strategic Priorities: How medical technology companies are shifting their focus from new product pipelines to optimizing existing offerings.

- The Power of Trigger-Based Sales: A deep dive into how real-time market signals can transform your sales strategy and connect you with high-value prospects at the exact moment they need your services.

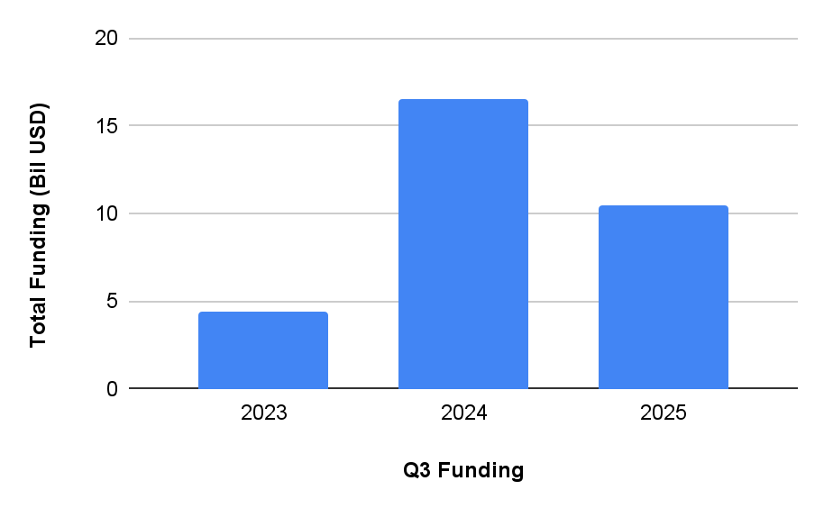

Total funding to MedTech Companies (Q3 YoY)

MedTech service providers face a challenging market as venture capital funding shifts. While some reports indicate an overall increase in funding for MedTech, this is largely due to fewer but larger deals, meaning less capital is distributed across the industry. For MedTech service providers, this means that the "spray and pray" approach of congratulating a newly funded company and immediately pitching services is no longer sustainable. Specifically, Q3 funding dropped by 37% ($6.1 billion USD) from last year.

A new strategic approach is necessary for growth, focusing on sales effectiveness over mere efficiency. Investing in a long-term strategic partner that can help a business scale is critical to navigating this environment, rather than just throwing money at disparate sales prospecting tools and outsourced solutions. Maximizing ROI and minimizing customer acquisition costs (CAC) through streamlined processes and systems is now more important than ever.

To adapt to this new reality, MedTech service providers can draw inspiration from Elon Musk's process for scaling, a framework that prioritizes effectiveness before efficiency. This approach encourages companies to question every requirement (nice to have versus a need to have), delete unnecessary processes or parts, and only then simplify and optimize what remains. Following these foundational steps, companies can then accelerate cycle time and finally, automate their most effective processes. By applying this logic to sales and marketing, a business can first ensure its cold outreach and messaging are highly effective before attempting to scale them.

The Power of Trigger-Based Sales

In a market where funding is more concentrated, trigger-based sales and marketing are critical. This proactive, precision-targeted strategy moves away from blanket outreach and focuses on engaging with prospects at the exact moment they need a service. For example, a company with a new round of funding or one that has just announced a clinical milestone is likely to need new services. The ability to identify these moments real-time allows for hyper-personalized outreach that is far more likely to convert.

Zapyrus is a sales enablement platform built for this purpose, empowering MedTech service providers to move beyond reactive efforts. By providing real-time sales signals and alerts, Zapyrus enables businesses to focus on high-value opportunities and build more predictable pipelines. The platform centralizes market intelligence, clinical data, and company information, allowing commercial teams to craft targeted campaigns and establish stronger client relationships based on an understanding of their evolving needs. With this data-driven approach, companies can ensure they're engaging with the right accounts at the right time, thereby maximizing their ROI and setting themselves up for sustainable, long-term growth.

Largest growth opportunity for MedTech service providers by region

Looking at the total funding between 2023 and 2025 YTD by region, we can see that APAC is the most stable over the past 3 years but received the lowest amount of funding investment. If we apply a linear fit model to this data, we should expect to see that funding in the Americas should cap off at $40 billion (~$5B higher than 2024) dollars by the end of 2025. The EMEA region should reach a similar $10 Billion dollar total from 2024 and APAC should see a small increase in annual funding by a couple of percentage points.

Looking at the total funding between 2023 and 2025 YTD by region, we can see that APAC is the most stable over the past 3 years but received the lowest amount of funding investment. If we apply a linear fit model to this data, we should expect to see that funding in the Americas should cap off at $40 billion (~$5B higher than 2024) dollars by the end of 2025. The EMEA region should reach a similar $10 Billion dollar total from 2024 and APAC should see a small increase in annual funding by a couple of percentage points.

As service providers, if 2024 was not an ideal growth year for you then consider looking at your strategy, process, and tools because 2025 is seeing similar funding trends and risk aversion from investors and MedTech OEMs as 2024.

The Americas present the most growth opportunities by dollar value, however with the recent changes in US government and FDA cuts, it makes it extremely difficult to bring a device to market. EMEA is a smaller market by funding amounts. However with the wait lines from the MDR/IVDR changes significantly reduced, it presents a more attractive go to market channel for MedTech companies who are looking to reduce the risk of uncertainty in the USA. This affects both new medical devices from emerging MedTech companies and expansion strategies from established medium sized companies and large strategies.

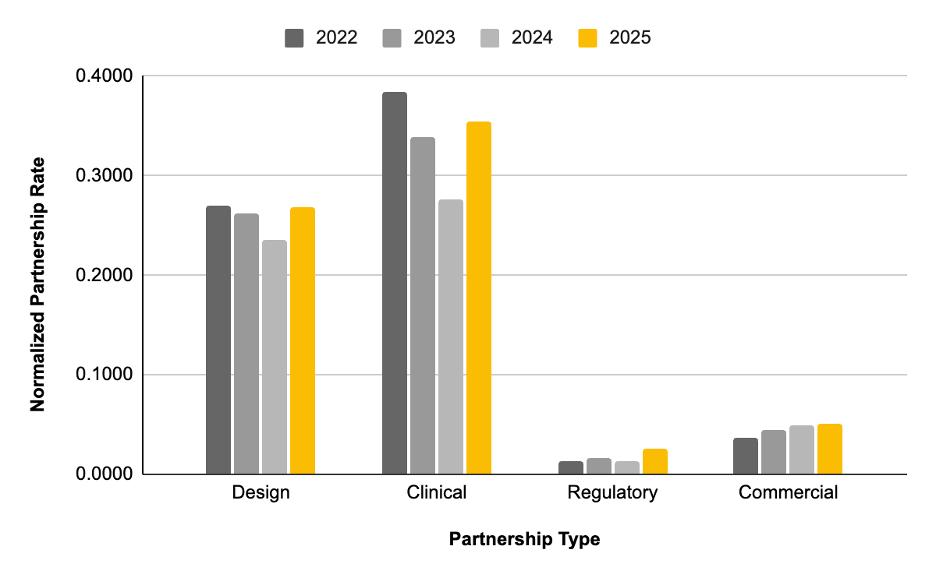

Services MedTech companies are most likely to outsource (clinical trials, regulatory, lab testing, staffing)

Zapyrus tracks publicly-announced partnership events, which can be used to baseline and benchmark the rates in which MedTech OEMs have outsourced particular types of services over the past 5 years. We acknowledge that publicly-announced outsourcing partnerships do not fully capture the outsourcing market, but in this case it can be an accurate model when we keep the search parameters the same across the 4 years of data and compare the datasets.

Across the board, outsourcing volume has increased from 2024 to 2025 to date.

Specifically, regulatory strategy and consulting outsourcing has doubled (100% increase in demand) compared to the last 3 years. This is likely due to the EU regulatory changes and now the FDA/NIH uncertainty. We expect the demand for consulting to increase with the increasing regulation and uncertainty around geo-polytics. The reduction of staff in the FDA and the cost of an FDA pre-sub/Q-sub being $40K-$50K creates a bottleneck in submission review, extending development timelines. Regulatory services should look to help minimize wait times by offering FDA pre-sub/Q-sub packages and factor in strategies to help MedTech CEOs move their development timelines forward without waiting on the results of the FDA presubmissions.

Design & development outsourcing has also increased ~13% likely due to MedTech OEMs with funding developing larger pipelines which are beyond the development bandwidth and capabilities of internal teams to keep up with. We anticipate an increase in outsourcing of design and development services, projected to be at an all time high in 2025 compared to the past 3 years.

MedTech clinical solutions outsourcing increased by 25% between 2024 to 2025 to date. Clinical outsourcing is growing at the fastest rate and volume. This is likely due to the increased regulatory demands from notified bodies and other regulators around the globe, which increases the risk of failure for MedTech companies who are bringing a novel device to market for the first time or think they have a predicate device that they can build an approval strategy around. Experienced leaders that have brought a device to market in the past fully know the value of a good clinical outsourcing partner in regards to risk reduction and maximizing success post regulatory approval.

The demand in outsourcing design & development, regulatory, and clinical findings from above is strongly supported by the above data, showing a large decline in the hiring rates for all three types of functions (design, clinical and regulartory except for commercial roles, which continue to stay strong.

The demand in outsourcing design & development, regulatory, and clinical findings from above is strongly supported by the above data, showing a large decline in the hiring rates for all three types of functions (design, clinical and regulartory except for commercial roles, which continue to stay strong.

Specifically design & development internal hires decreased by 46%, regulatory down by 36%, and clinical down by 28%. The trend is clear, medical technology companies are increasing their outsourcing partnerships and reducing their insourcing in these uncertain times. The MedTech market is shifting rapidly from a historical insourcing model to an outsourcing model.

The reasons are based on multiple critical factors:

- #1: The time to bring a medical device to market is relatively short and therefore the tolerance for errors is low. Internal hires to scale takes a lot of time and resource investments that most MedTech companies can’t afford.

- #2: Roles that solve for design & development, regulatory strategy, and clinical trial problems are mostly temporary and therefore it makes more sense for companies to outsource that capability in order to move faster and mitigate risk to failure before their funding dries up.

- #3: Investors are more risk averse and want to see a return sooner. Investors want sure bets on ROI. Therefore, they want to see MedTech CEOs prioritize efficiency and effectiveness to bring devices to market and start generating revenue.

- #4: MedTech company exits are at a later stage than before. Strategic purchases on MedTech companies are at later stages to derisk the purchase with a focus on rapid plugging their well trained commercial teams on proven products that have a strong product market fit.

The large commercial role hires indicates an insourcing of commercial growth as MedTech companies look to grow revenue on marketable devices and products. This supports the focus on maximizing ROI on revenue acquisition.

Are we seeing a talent drain from the agencies to industry, and what does that imply for regulatory review rigor, speed, or bias?

%20and%20PMA%20applications%20over%20the%20past%2012%20months.%20Note%20that%20there%20were%20no%20novel%20PMA%20approvals%20in%20March%202025..png?width=900&height=480&name=Average%20number%20of%20days%20between%20application%20submission%20and%20approval%20by%20the%20US%20FDA%20for%20510(k)%20and%20PMA%20applications%20over%20the%20past%2012%20months.%20Note%20that%20there%20were%20no%20novel%20PMA%20approvals%20in%20March%202025..png) The average approval time for 510(k) in the past 12 months is 148 days with every month being stable. This indicates no impact in geo-polytical challenges, policy changes, FDA/NIH cuts having any positive or negative impact on 510(k) devices being approved on time.

The average approval time for 510(k) in the past 12 months is 148 days with every month being stable. This indicates no impact in geo-polytical challenges, policy changes, FDA/NIH cuts having any positive or negative impact on 510(k) devices being approved on time.

PMA average approval times is where the data is interesting. Since January 2025 (the waiting peak of 970 days), the average PMA approval time dropped significantly to 217 days as recently as August 2025. However, September has seen a relatively large increase in PMA approval time, currently at 466 days, a 115% increase in time to approval delays. This is concerning because this spike in wait times is outside the variance between February 2025 to August 2025. Only time will tell if this trend is expected to grow with the most recent FDA layoffs from the US government.

There’s an opportunity here for consulting service providers to help MedTech companies speed up their PMA approval process.

Which companies (top 25 MedTechs, mid-tier, or startups) are building internal regulatory teams versus relying on external partners?

%20companies%20in%20the%20Startup%2c%20Mid-size%2c%20and%20Large%20employee%20count%20brackets..png?width=936&height=578&name=Number%20of%20companies%20employing%20Internal%20or%20External%20regulatory%20support%20strategies%20out%20of%2025%20top%20(revenue%20and%20funding)%20companies%20in%20the%20Startup%2c%20Mid-size%2c%20and%20Large%20employee%20count%20brackets..png)

Out of the top 75 MedTech companies by revenue and funding, the only company appearing to be working on an internal strategy for building regulatory teams is Neuralink. This makes a lot of sense given the complexity and novelty of Neuralink technology, funding level and publicity.

Approximately 29% of top 75 MedTech companies are actively seeking external partnership strategies for regulatory support. The majority of the top 75 MedTech companies (69%) have unclear regulatory partnership strategies. However, we can assume the same ratio of companies in this pool of medical technology companies mirror the other 23 companies. This finding signifies a massive opportunity for regulatory service firms to work with these larger strategic companies as a long term partner.

Have the changes in Medicaid, tariffs, and manufacturing pressures changed how companies are looking to invest in new products and existing products, given reimbursement pressures?

The average pipeline investment between 2025 YTD and 2024 has significantly dropped by 28% equating to an average of 2188 less patents awarded. This indicates an investment in growing the existing pipeline (Zapyrus has data on) rather than accelerating new products in the pipeline.

The average pipeline investment between 2025 YTD and 2024 has significantly dropped by 28% equating to an average of 2188 less patents awarded. This indicates an investment in growing the existing pipeline (Zapyrus has data on) rather than accelerating new products in the pipeline.

The graph above confirms that companies are focusing on existing products by the increase in focus on existing product development in the past 6 months compared to 6-12 months prior. We also see a slight increase in new product focus in the past 6 months. However, the companies that focus on both new products and existing products have decreased to an all time low since the past 18 months of recorded data.

The graph above confirms that companies are focusing on existing products by the increase in focus on existing product development in the past 6 months compared to 6-12 months prior. We also see a slight increase in new product focus in the past 6 months. However, the companies that focus on both new products and existing products have decreased to an all time low since the past 18 months of recorded data.

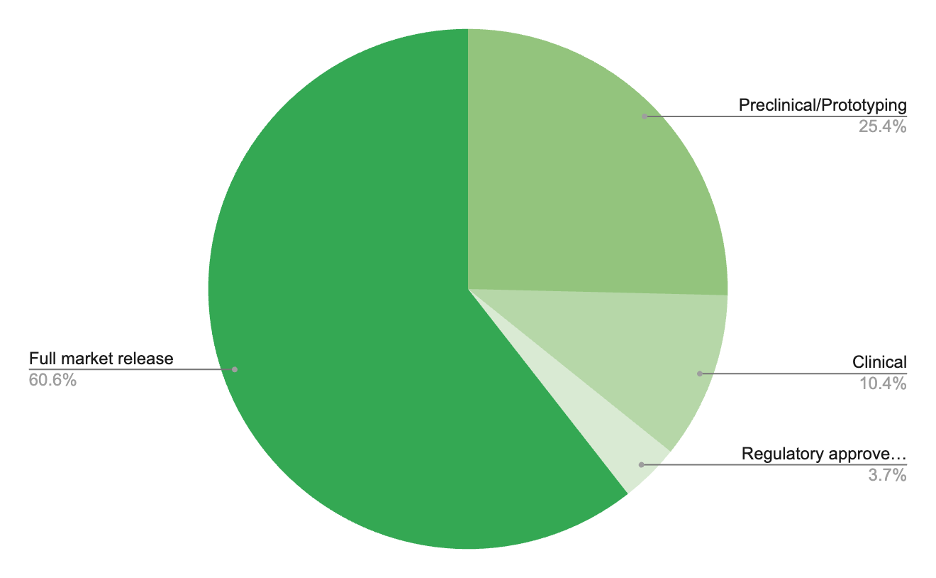

The evolution of MedTech companies:early prototyping, formal development, clinical trials, limited market release, full market release

Approximately, 25% of medical technology companies are in the preclinical/prototype development stage, 10% of companies are at the clinical stage, 10% of companies have a recent regulatory approved product, and 61% of companies have at least one fully released product in the market.

Service providers need to maximize their time and money to target conversations with prospective clients that are at the right stage of service.

What’s the appetite for integrated CRO services versus point solutions?

We looked at the partnership ratio between MedTech companies and integrated CROs since Q1 2021. The rate of MedTech companies seeking a fully integrated CRO partnership has declined significantly from a peak of 19% as recently as Q3 2024 to its lowest in 4 years down to 10%.

We looked at the partnership ratio between MedTech companies and integrated CROs since Q1 2021. The rate of MedTech companies seeking a fully integrated CRO partnership has declined significantly from a peak of 19% as recently as Q3 2024 to its lowest in 4 years down to 10%.

MedTech OEMs are looking to derisk their clinical trials by working with many different CROs to ensure that projects get delivered on-time and on-budget. MedTech companies are seeing specialized firms to fragment off components of their clinical projects.

Conclusion

In a market defined by concentrated funding and heightened risk aversion, the traditional sales playbook is obsolete. The insights from Zapyrus's MedTech market report make it clear: MedTech companies are no longer prioritizing a "build it all internally" model. Instead, they are increasingly outsourcing critical functions like regulatory, clinical, and design & development to expert partners who can accelerate timelines and mitigate risk. For MedTech service providers, this shift presents massive opportunities, but only for those who adapt. The future of MedTech sales lies in precision, moving away from broad-based outreach and toward a trigger-based sales and marketing model that targets companies at key inflection points, such as a new funding round or a clinical milestone.

By embracing this data-driven approach, MedTech service providers can transform their business, moving from a reactive, unpredictable pipeline to a proactive, reliable growth engine. This is not just about survival; it's about capitalizing on a fundamental market shift to become an indispensable strategic partner, maximizing ROI for both your business and your clients.